Financially savvy female investors defy stereotypes

- Written by Brooke Roberts, Co-Founder and Director, Sharesies AU

Investing business Sharesies has unearthed stereotype-defying data highlighting the changing face of the Australian investor community. Recent figures show that within the three-month period surveyed, the risk appetite of female-identifying investors on the Sharesies platform has increased more than their male-identifying counterparts’.

The new data, which explores the behavioural changes of investors, revealed that investor risk appetite from April to June 2022 increased amongst women, more than men, highlighting a 20% gap (60% vs. 40%). With the market being as volatile as it is, it begs the question of whether females are more open to trial and error than their male counterparts, or if they are simply more excited by the prospect of a bargain —whether it’s in stores or on the stock market.

Regardless, the data suggests that women aren’t feeling put off by the challenging market conditions. Their willingness to invest also extends beyond the stock market with data highlighting that women are more likely to invest in cryptocurrency than men (55% vs. 45% respectively) and also report holding more property in their portfolio than males (57% vs. 43% respectively).

It is refreshing to see the data reflect confident and financially-savvy women. While formal personal financial education in school remains a bit of a no man’s land, it is imperative for women especially, that we set ourselves up to make the most of our money and for a comfortable future, particularly through investing for the long-term. There are a few key factors that explain why it’s just so important.

Women tend to earn less money

There are all kinds of reasons for this — female-dominated professions tend to pay less than male-dominated professions, women tend to take more time off work to fulfil a care-taking role for the family, and women continue to be under-represented in high-earning, top leadership roles. Put simply, if you make less money, then you have less income to draw from for your savings. Investing in shares can help to compensate for this by giving you the potential for higher returns than a bank account and hopefully putting you in a better place at the end of your career.

Women live longer

Women’s savings need to last longer, because on average, they tend to live longer than men. Not only do men earn more, and tend to invest in shares more, they also don’t need to make their money last as long, because they’re more likely to check out at a younger age than women.

The good news

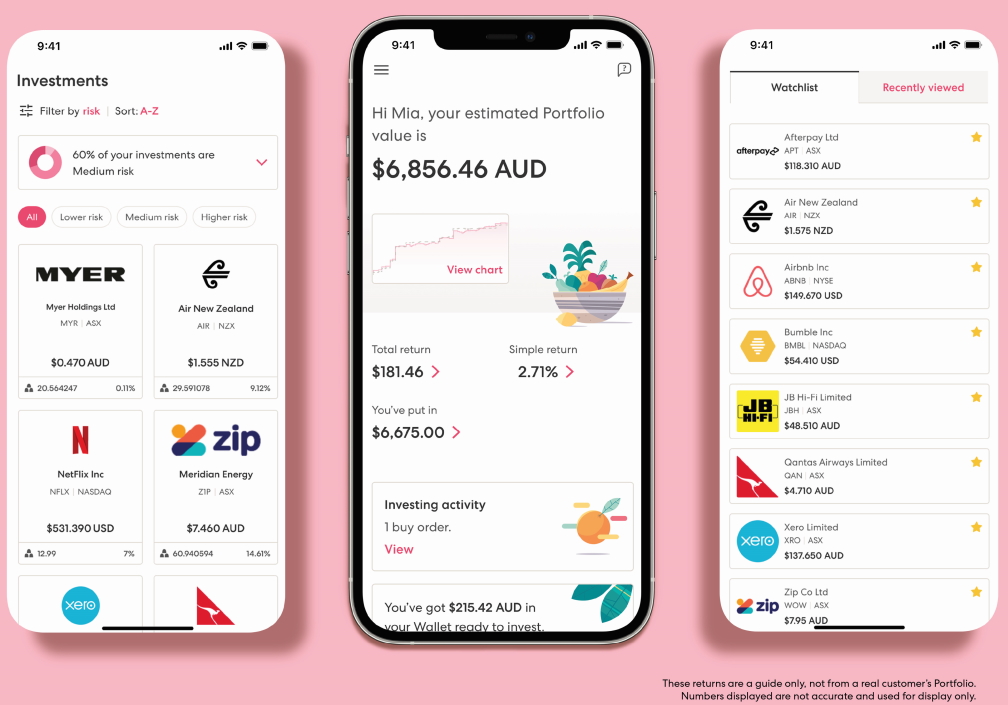

As highlighted in the recent data, the face of investing is changing. Investing is now easier and more accessible than ever. Australians can invest from as little as they want, choose from a range of investing options, and learn as they go. At Sharesies, we see the direct impact of this as currently; just over half of AU investors on the Sharesies platform are women. We can’t wait to see what comes next.

Disclaimer

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don't provide tax advice, personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.